2025 marked a significant year for real estate.

Across the United States, rampant concerns about rising utility rates, grid instability, and the imposition of building decarbonization fines kept property owners and operators on their toes.

Multifamily and hotel buildings were no exception.

Propmodo predicts a multifamily recession in 2026, and CoStar reported that for the first time since 2020, hotel occupancy and revenue per available room saw a decline in 2025.

Revenues are expected to decline while costs are skyrocketing, leaving bottom lines in the danger zone.

Whether it’s New York or California, a rental or hotel, building staff need to be aware of curveballs headed their way so that they can stay ahead of them.

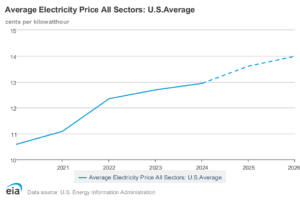

Runaway utility rates have been the central topic of concern in recent months.

Distress over rising energy costs has grown so substantial that multiple gubernatorial and mayoral races across different states ran on, and won, platforms vowing to fight back against these rising rates.

For example, a Utility Dive article covering the newly elected governor of Virginia, Abigail Spanberger, D, and her administration’s focus on clean energy and energy affordability cites, “Governor-elect Spanberger and fellow Democrats outlined their strategy agenda last month, emphasizing the need to lower costs.”

Across state lines and sectors of real estate, the burden of rising utility rates is hitting everyone hard.

Image Source: The EIA, Average Electricity Price All Sectors: U.S. Average

However, residential real estate seems to be taking the worst hit.

According to the EIA, the national average residential price per kilowatt hour in 2026 is 18 cents, a 37% increase since 2020.

Simply put, properties are spending 37% more on utility costs for the same amount of consumption.

Overall, according to Utilities Dive, “…regardless of how increases compare with overall inflation, residential rates have risen faster than those for commercial and industrial customers, shaping public perceptions about fairness.”

For multifamily buildings and hotels, where HVAC systems represent a significant portion of operational expenses, rising utility rates can severely impact budgets and bottom lines.

Building owners and operators have to seek out intelligent solutions to optimize their energy consumption.

This isn’t about turning down thermostats; it’s about implementing sophisticated systems that learn, adapt, and predict energy needs based on your building.

By reducing unnecessary energy waste, buildings can mitigate the impact of rising utility rates and free up resources for other critical investments.

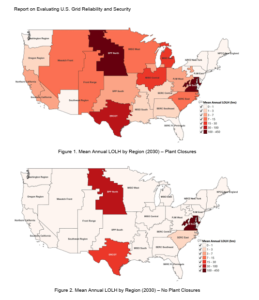

As our energy infrastructure ages and demand grows, grid instability is becoming a more frequent issue.

Some areas struggle with grid instability more than others. This is especially true for areas where data centers are expected to be built.

Image Source: GridBeyond, US grid reliability and security at risk, warns DOE

Increasing demand, coupled with data center load requirements, adds an unprecedented amount of weight added to an already strained grid.

Unfortunately, the grid is arguably one of the most inflexible structures. It takes a huge amount of time, planning, and capital to build up to boost its transmission capacity.

This solution could take years and, in that time, have already caused blackouts or failures, leading to disruptions in building operations and disgruntled residents or guests.

The root of the problem is too much necessity, too little capacity.

In 2026, a central focus will be on maximizing the use of existing infrastructure and squeezing out every bit of existing capacity.

Demand response programs incentivize large energy consumers, like multifamily buildings and hotels, to reduce their energy usage during peak demand periods.

Participating in demand response offers a win-win scenario; buildings earn financial incentives for shedding load when the grid is stressed, while simultaneously contributing to grid stability and reliability.

Optimizing HVAC systems allows multifamily buildings and hotels to turn into Grid-Interactive Efficient Buildings (GEBS) that earn revenue from program payouts.

Buildings need HVAC systems that can intelligently adjust energy consumption without compromising occupant comfort.

This proactive approach to energy management will be crucial for both financial gain and operational resilience.

The push for a greener future is intensifying, and with it, a wave of building decarbonization laws is sweeping across regions.

Building decarbonization standards like NYC’s Local Law 97 (LL97), Boston’s Building Energy Reporting and Disclosure Ordinance (BERDO), and the DMV’s Building Energy Performance Standards (BEPS) are setting stringent limits on carbon emissions from existing buildings.

While the focus of these building decarbonization ordinances strives for greater sustainability in residential real estate, they carry significant financial implications that affect properties, including hefty fines for non-compliance.

They necessitate a fundamental rethinking of building operations, particularly HVAC systems.

Older, inefficient HVAC systems are major contributors to carbon emissions.

To comply with building decarbonization regulations and avoid penalties, buildings must invest in modernization and optimization.

Retrofitting building equipment can take years for approval and installation, and requires massive capital expenditure.

Optimizing existing HVAC systems is a quicker solution that promises faster returns and complies with building decarbonization standards in the near term.

Properties can benefit from reduced CO2 emissions from HVAC systems consuming less energy, translating to reduced fines from building performance standards.

However, compliance with local laws is only one part of the story.

The necessity for building decarbonization reaches beyond the need to operate more sustainably; it enhances the operational efficiency of their buildings, improves their market value, and attracts environmentally conscious tenants, guests, and investors.

Managing a multifamily and hotel building is growing increasingly complicated.

Property management has shifted from overseeing operations to actively sourcing the most efficient ways of operating buildings while producing maximum value.

With trends pointing toward declining occupancy rates in both multifamily properties and hotels, getting smart with securing bottom lines against costs and fines is the only way to survive.

The challenges of 2026—rising utility rates, grid instability, and building performance standards—are significant, but so are the opportunities for those who adapt.

With trends pointing toward declining occupancy rates in both multifamily properties and hotels, getting smart with securing bottom lines against costs and fines is the only way to survive.

The challenges of 2026—rising utility rates, grid instability, and building performance standards—are significant, but so are the opportunities for those who adapt.

HVAC optimization as a service provides a comprehensive solution, enabling multifamily buildings and hotels to navigate these threats successfully.

By leveraging advanced analytics, intelligent controls, and expert insights, buildings can:

525 West 52nd Street, a 24-floor luxury rental building in Manhattan, New York, was facing rising utility rates, high energy consumption, and looming LL97 fines.

With the optimization of the building’s water-sourced heat pumps that provided central heating and cooling, the building was projected to save at least $39,848 in guaranteed utility costs in its first year working with Parity.

Performance outdid projections, and we delivered $67,702 in utility cost savings. That’s 1.6x more in achieved savings than was predicted.

No expensive retrofits or proprietary hardware—only existing HVAC systems being optimized.

The optimized HVAC systems prevented 42 tons of CO2 emissions, translating to $11,148 saved from potential LL97 fine exposure.

To top it off, Parity automated demand response curtailment, generating $15,000 in demand response revenue.

All in all, 525 West 52nd was able to contribute over $90,000 toward the property’s bottom line, which would have otherwise been expended on unnecessary costs and fines.

During a time of unprecedented rising energy costs and building decarbonization fines, “every dollar counts,” says Andrew Schwartz, Senior VP of Residential Asset Management at Taconic Partners.

The future of energy efficiency is here, and it’s smart, sustainable, and optimized.

To learn more about how Parity’s HVAC optimization service can help achieve utility cost savings and reduce fines from building performance standards, contact contact@paritygo.com or call 1-833-372-7489.